Mortgage in UAE for Expats

Buying your first home in the UAE is both exciting and daunting—especially if you’re an expat navigating a new system. From eligibility rules to bank approvals, the process can feel larinthine. This guide breaks it down into clear, actionable steps so you can move from aspiration to ownership with confidence.

Step 1: Understand Who Can Apply for a Mortgage in the UAE

- Eligibility: Most banks in the UAE offer mortgages to salaried and self-employed expats, provided they meet minimum income thresholds (usually AED 10,000–15,000 monthly for salaried applicants).

- Residency: A valid UAE residence visa is typically required, though select lenders extend options to non-residents.

- Age Limits: Borrowers must usually be between 21 and 65 (salaried) or 70 (self-employed) at loan maturity.

“To qualify for a mortgage in the UAE as an expat, you need a valid residency visa, meet income criteria (AED 10K+), and fall within the age eligibility range set banks.”

Step 2: Know the Types of Mortgages Available

Choosing the right product shapes your repayment comfort:

- Fixed-Rate Mortgage – Rate stays constant for a set term (1–5 years), shielding you from interest fluctuations.

- Variable-Rate Mortgage – Rate moves in line with the EIBOR (Emirates Interbank Offered Rate). Payments can rise or fall.

- Islamic Mortgage Products – Sharia-compliant models like Murabaha (cost-plus), Ijara (lease-to-own), and Musharakah (co-ownership).

Tip: Many expats prefer starting with a fixed rate for predictability, then refinancing later.

Step 3: Budget Wisely – Down Payment & Fees

- Down Payment: For expats, the Central Bank requires at least 20–25% of the property price as a down payment.

- Associated Fees: Expect 6–7% of the property value to go toward Dubai Land Department (DLD) fees, bank processing charges, valuation fees, and broker costs.

- Example: For a property worth AED 1 million, expats need AED 200K–250K upfront, plus AED 60K–70K for fees.

Step 4: Check Your Affordability & Creditworthiness

Before lenders do, check yourself:

- Debt-to-Income Ratio (DTI): Monthly mortgage + existing debt payments shouldn’t exceed 50% of income.

- Credit Score: Issued the Al Etihad Credit Bureau (AECB). A good score (>700) boosts approval odds.

- Employment Stability: Banks favor at least 6–12 months with your current employer.

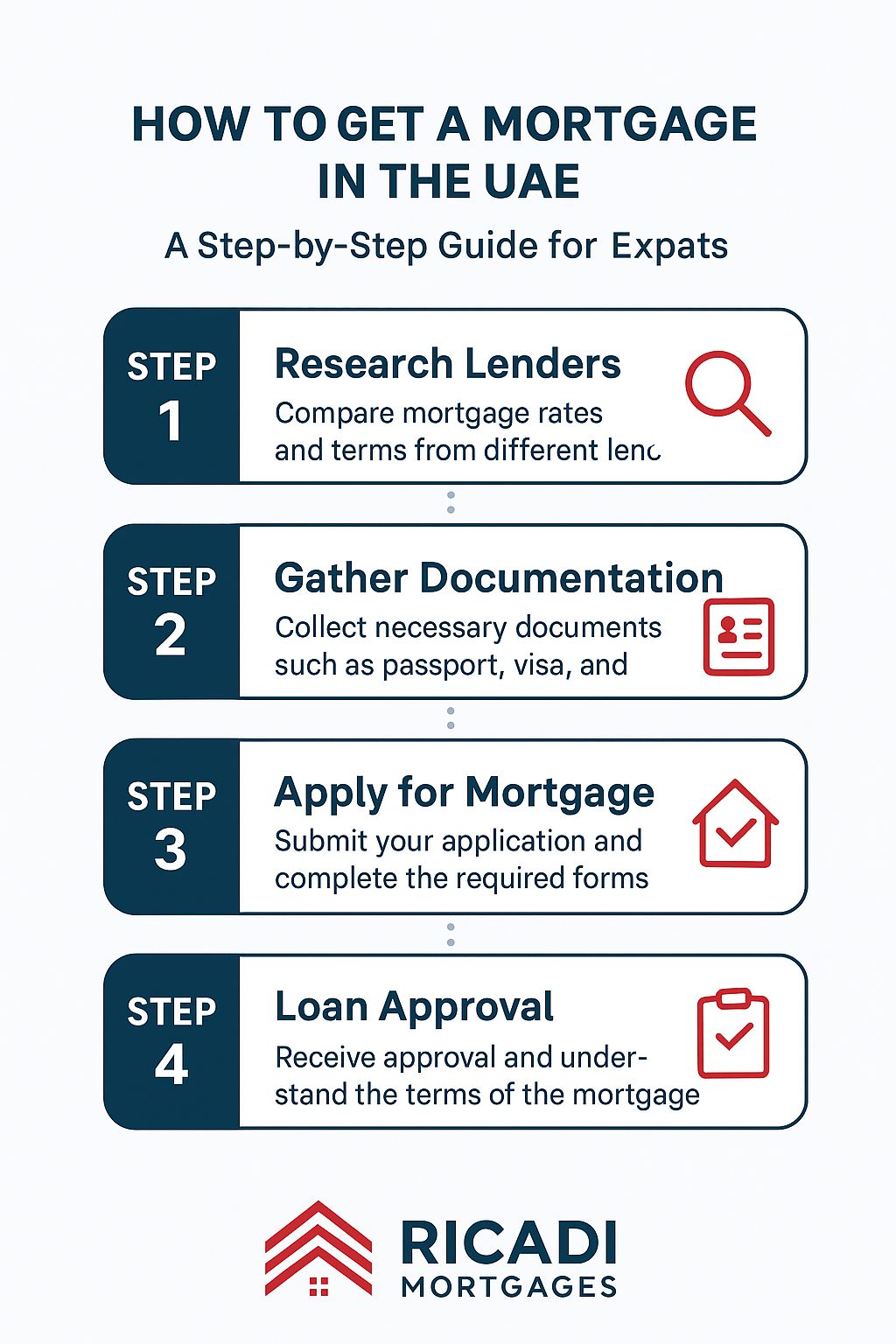

Step 5: Get Pre-Approval from a Bank

This is your passport to confident property hunting.

- Pre-Approval Benefits: Fixes your borrowing capacity, shows sellers you’re a serious buyer, and speeds up final approval.

- Validity: Usually valid for 60–90 days.

- Documents Needed: Passport, visa, Emirates ID, salary certificate, payslips, bank statements (6 months), and proof of existing liabilities.

Step 6: Choose the Right Property

Not every property is mortgage-eligible.

- Freehold Properties: Most expats can buy in designated freehold areas across Dubai and Abu Dhabi.

- Approved Developers: Lenders maintain lists of pre-approved developers and projects.

- Valuation: The bank will independently value the property—your loan amount is based on the lower of purchase price vs. valuation.

Step 7: Final Mortgage Approval & Offer Letter

- Once the property is selected, the bank issues a Final Offer Letter (FOL) after completing due diligence.

- This confirms the loan amount, tenure (up to 25 years), rate type, and repayment schedule.

Step 8: Transfer of Ownership & Mortgage Registration

- Memorandum of Understanding (MoU): Signed between buyer and seller, often with a 10% deposit.

- Mortgage Registration: With the Dubai Land Department (DLD) or relevant authority. Fees apply (typically 0.25% of the loan amount).

- Final Step: Title deed issued in your name, with the mortgage registered against the property.

Step 9: Plan for Repayments & Refinancing Options

- Repayments: Usually through post-dated cheques or direct debit.

- Early Settlement Fees: Typically 1% of the outstanding loan (or capped at AED 10,000, depending on bank rules).

- Refinancing: After a fixed term, many expats refinance to secure better variable or fixed rates.

Quick Checklist for Expats Getting a Mortgage in the UAE

- Minimum down payment of 20–25%

- Mortgage eligibility tied to income, residency, and credit score

- Budget 6–7% for fees and charges

- Pre-approval is crucial before property search

- Choose freehold properties from approved developers

- Expect repayment tenures up to 25 years

Final Word: Simplifying the Journey

For expats, securing a mortgage in the UAE can feel complex—but with the right partner, it becomes seamless. At Ricadi Mortgages, we specialize in guiding first-time buyers through every step, ensuring transparent advice, tailored loan comparisons, and faster approvals.

Reach out today to start your homeownership journey in Dubai and beyond.