How Much Mortgage Can You Afford in the UAE? Try This Formula

Buying a home in the UAE is one of the most exhilarating milestones for expats and residents alike. The glittering skyline of Dubai, the serene communities of Abu Dhabi, or the upcoming hotspots in Sharjah all invite you to invest, not just financially, but emotionally. Yet, the golden question remains: how much mortgage can you actually afford in the UAE?

Unlike casual property browsing, mortgage affordability is bound strict regulations, formulas, and financial prudence. Get it right, and you unlock your dream villa or apartment. Get it wrong, and you risk years of financial strain.

This blog is your complete, practical, and precise guide to calculating mortgage affordability in the UAE—supported real-world examples, Central Bank rules, and expert insights from Ricadi Mortgages.

Why Mortgage Affordability Matters in the UAE

The UAE mortgage market is unlike many others:

The UAE Central Bank caps your Debt Burden Ratio (DBR) at 50% of your monthly income.

Down payment requirements differ between expats (20%) and UAE nationals (15%) for properties under AED 5 million.

Loan tenures are capped at 25 years or until retirement age (65 years for expats, 70 for UAE nationals).

This means your dream home’s price tag isn’t just about what you want—it’s about what you can prudently sustain within the regulatory framework.

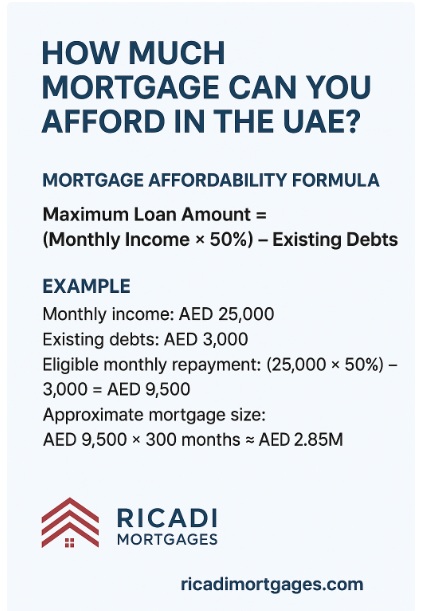

The Mortgage Affordability Formula

Here’s the simplified formula that defines Mortgage Affordability in the UAE:

MaximumLoanAmount=(MonthlyIncome×50%)–ExistingDebtsMaximum Loan Amount = (Monthly Income × 50\%) – Existing Debts

Multiply this the maximum loan tenure in months (up to 300 months = 25 years) to estimate your potential mortgage.

A Step Step – Formula for Mortgage Affordability In the UAE

In the UAE, mortgage affordability is calculated using the Debt Burden Ratio (DBR) rule, which allows you to spend up to 50% of your Net Monthly Income (NMI) on debt repayments, including mortgages.

- Calculate NMI (Net Monthly Income): Salary + allowances – deductions.

- Apply the DBR rule: Up to 50% of NMI can be used for debt.

- Subtract existing debts: Loans, car finance, credit cards.

- Find maximum mortgage payment: Max Mortgage Payment=(NMI×50%)−(Existing Debt)\text{Max Mortgage Payment} = (NMI \times 50\%) – (\text{Existing Debt})Max Mortgage Payment=(NMI×50%)−(Existing Debt)

- Calculate loan amount (with interest & tenure): Loan Amount=Max Mortgage Payment×(1−(1+r)−n)r\text{Loan Amount} = \frac{\text{Max Mortgage Payment} \times \left(1 – (1 + r)^{-n}\right)}{r}Loan Amount=rMax Mortgage Payment×(1−(1+r)−n) Where:

- r = monthly interest rate (annual ÷ 12)

- n = loan tenure in months (years × 12)

Example 1:

Monthly income: AED 25,000

Existing debts (car loan + credit cards): AED 3,000

Eligible monthly repayment: (25,000 × 50%) – 3,000 = AED 9,500

Approximate mortgage size: 9,500 × 300 months = AED 2.85M

This formula is snippet-worthy, easy to recall, and trusted financial advisors across the UAE.

Key Factors That Affect Mortgage Affordability in the UAE

- Monthly Income – Higher income means higher DBR capacity.

- Existing Debts – Credit cards, car loans, or personal loans reduce your available repayment room.

- Nationality – Expats vs. UAE nationals have different down payment rules.

- Age – Younger buyers can access the full 25-year tenure.

- Interest Rates – Fixed vs. variable rates alter long-term affordability.

- Property Value – Higher-value homes mean higher mandatory down payments.

Real-Life Scenarios (Names Changed)

Case 1: Ramesh in Dubai

Salary: AED 18,000/month

Debts: AED 2,000

Eligible monthly repayment: (18,000 × 50%) – 2,000 = AED 7,000

Loan size: 7,000 × 300 = AED 2.1M

With a 20% down payment, Ramesh can afford a property around AED 2.6M.

Case 2: Anna in Abu Dhabi

Salary: AED 45,000/month

Debts: AED 0

Eligible monthly repayment: 22,500

Loan size: 22,500 × 300 = AED 6.75M

Anna can comfortably consider homes in the AED 8.4M range with a 20% down payment.

Insight: Even strong earners must factor in down payments and ancillary costs before committing.

Tips to Maximize Mortgage Affordability

- Boost your credit score – Pay off credit cards on time.

- Lower your debts – Clear car or personal loans before applying.

- Save for a higher down payment – Increases property options and reduces borrowing burden.

- Choose longer tenures wisely – Stretching to 25 years lowers monthly payments but increases total interest.

- Shop for the best rates – Ricadi Mortgages compares across UAE banks to get you optimal terms.

Hidden Costs Expats Often Overlook

Mortgage affordability isn’t just the loan—it’s also fees:

- Dubai Land Department (DLD) fee: 4% of property value.

- Mortgage registration fee: 0.25% of loan amount.

- Bank arrangement fee: 1% of loan amount.

- Valuation fee: AED 2,500 – AED 3,000.

- Property insurance: Annual premiums vary.

These add-ons can easily add AED 100,000+ to your upfront costs for mid-to-luxury properties.

FAQs on Mortgage Affordability in the UAE

Q1: How much salary do I need to buy a house in Dubai?

At least AED 15,000/month is recommended to qualify for entry-level mortgage approvals.

Q2: Can expats get 100% mortgage in UAE?

No, expats must put a minimum of 20% down payment for properties under AED 5M.

Q3: How much down payment is required in Dubai?

Expats: 20% minimum.

UAE Nationals: 15% minimum.

Q4: What is the maximum loan tenure in UAE?

25 years, subject to retirement age (65 for expats, 70 for nationals).

Q5: How does variable vs. fixed rate affect affordability?

Fixed rates offer predictable EMIs, while variable rates can start lower but fluctuate with market changes.

Conclusion: Affordability Starts with Clarity

Mortgage affordability isn’t a puzzle once you know the formula—it’s a structured path. With income, debts, tenure, and costs aligned, you can confidently define your property budget.

But numbers are only half the story. The real efficiency lies in strategy, negotiation, and bank--bank comparison—and that’s where Ricadi Mortgages excels.

Our experts don’t just calculate your affordability; they enhance it. From optimizing your debt profile to securing the lowest rates, we ensure that when you step into your dream home, your finances feel as comfortable as your living room.

+971 56 364 6906

https://ricadimortgages.com

Your mortgage journey starts with clarity—let Ricadi Mortgages be your guide.