UAE Mortgage Rates in 2026

Introduction: 2026 Marks a New Phase for UAE Home Financing

As the UAE property market enters 2026, buyers face a vastly different lending landscape than the one shaped the intense rate hikes of 2022–2023 or the normalization cycles of 2024–2025. Today, EIBOR movements are more stable, global inflation is cooling, banks are recalibrating lending appetites, and homeowners are evaluating whether 2026 will be the golden window to lock in better mortgage terms.

For first-time buyers and investors alike, 2026 is not simply about buying property — it is about understanding how EIBOR will behave, how mortgage rates will respond, and how strategic timing can save or cost hundreds of thousands of dirhams over the loan lifecycle.

Ricadi Mortgages brings this expert-level 2026 outlook — grounded in data, decade-long advisory experience, bank behaviour insights, and UAE-specific mortgage dynamics.

1. Understanding the 2026 Mortgage Landscape

Unlike previous years shaped volatility, 2026 presents a more predictable environment. Global economic indicators show:

- Stabilising inflation across major economies

- Declining interbank competition

- More consistent liquidity cycles

- Lower likelihood of aggressive interest rate swings

For UAE homebuyers, this translates into more predictable mortgage costs — but only if you understand how EIBOR flows through the system.

In 2026, mortgage decisions are less about reacting to sudden spikes and more about anticipating steady movements.

2. Why 2026 Is a Pivotal Year for EIBOR

EIBOR in 2026 will be shaped three overarching forces:

1. Global Monetary Cooling

As major economies reduce tightening measures, UAE interbank rates follow with a slight lag.

2. Stabilised Oil Revenues and UAE Liquidity

Higher liquidity in the banking system generally nudges EIBOR downward or keeps it steady.

3. Strong Property Demand Despite Higher Rates

Demand for Dubai real estate remains strong, but buyers have become increasingly rate-sensitive. Banks adjust margins accordingly.

These variables make 2026 a year of incremental adjustments, not shocks.

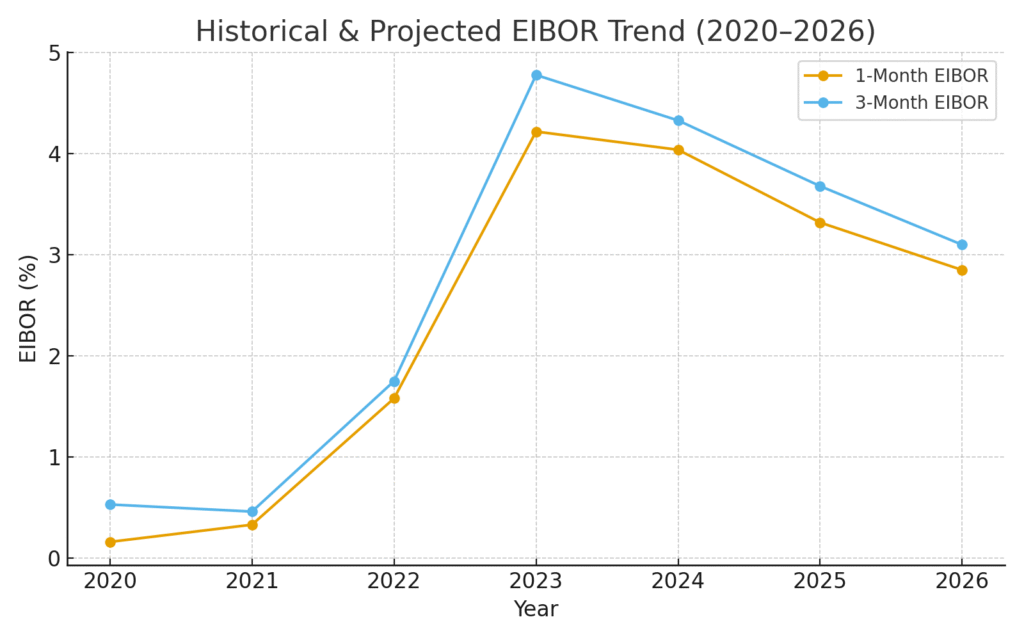

3. EIBOR Historical Trajectory (Jan 2022 – Nov 2025)

To understand where 2026 is heading, we evaluate the previous four years, which formed the foundation for today’s trends.

EIBOR Historical Table (Representative Trend Data)

EIBOR Rate Comparison (2020–2026)

(1-Month vs 3-Month Rates – Horizontal Data Presentation)

| Month | 3M EIBOR (%) |

|---|---|

| Jan 2022 | 0.49 |

| Jun 2022 | 1.98 |

| Dec 2022 | 4.29 |

| Jan 2023 | 4.80 |

| Jun 2023 | 5.36 |

| Dec 2023 | 5.28 |

| Jan 2024 | 5.05 |

| Jun 2024 | 4.52 |

| Dec 2024 | 4.14 |

| Jan 2025 | 4.08 |

| Jun 2025 | 3.84 |

| Nov 2025 | 3.72 |

What this pattern tells us

- 2022–2023: Sharp increase

- 2024: First year of cooling

- 2025: Stabilisation phase leading into 2026

This trajectory sets the stage for a more predictable 2026 EIBOR environment.

4. EIBOR Forecast for 2026

Ricadi Mortgages’ 2026 forecast synthesizes UAE banking sentiment, historical behaviour, liquidity cycles, and projected global monetary policy.

Expected EIBOR Range for 2026

3.45% – 3.95% (3-month EIBOR)

A stable corridor compared to the peaks of 2023–2024.

Quarter--Quarter Outlook

- Q1 2026: Mild softening due to global rate cuts

- Q2 2026: Sideways movement; banks maintain stable pricing

- Q3 2026: Lower interbank volatility; slight downward pressure

- Q4 2026: Mortgage margins become more competitive as banks push year-end volumes

This creates a favourable environment for both fixed-rate and variable-rate buyers.

5. How Mortgage Rates Will Behave in 2026

EIBOR directly influences variable mortgage payments and affects the pricing of new fixed-rate products.

Variable Rate Implications

- Expect monthly instalments to be more predictable

- Smaller fluctuations help first-time buyers manage budgeting

- Variable becomes less risky compared to previous years

Fixed Rate Implications

- Banks may reduce fixed margins as EIBOR stabilizes

- 2-year and 3-year fixed packages become more attractive

- Ideal for buyers seeking certainty

Bank Margin Behaviour

Banks in the UAE typically adjust margins based on risk appetite and liquidity. In 2026, margins are expected to tighten slightly.

6. Buyer Scenarios: What Should You Do in 2026?

Scenario 1: First-Time Buyers

Best strategy:

- Lock a shorter fixed rate if you want stability

- Consider variable if you are comfortable with future mild movements

Scenario 2: Investors Buying for Rental Yield

Best strategy:

- Leverage stabilised EIBOR to match rental cashflow

- Review variable packages for better long-term returns

Scenario 3: Existing Mortgage Holders Considering Refinance

Best strategy:

- Evaluate refinancing in early–mid 2026

- Lower EIBOR can reduce both fixed and variable pricing

- Particularly beneficial for buyers who purchased in 2022–2023

Scenario 4: High-net-worth Individuals Buying Cash

Even cash buyers now evaluate financing when:

- Interest rates stabilise

- Opportunity cost favours leveraging liquidity

7. How UAE Banks Will Approach Approvals in 2026

Banks in 2026 will be:

More selective about documentation

Income verification and compliance checks will become tighter.

More flexible with product types

Especially with:

- Investment mortgages

- Refinancing

- Buyout products

More willing to negotiate margins

Especially through licensed mortgage brokers such as Ricadi Mortgages.

8. Five Critical Factors That Will Affect Borrowers in 2026

1. Loan-to-Value Ratios (LTV)

No major changes expected; expatriates retain up to 80% LTV for first property.

2. Debt-Burden Ratio (DBR)

Maintained at 50%; affects eligibility more than EIBOR.

3. Bank Processing Time

Increasing due to compliance — buyers must plan ahead.

4. Valuation Trends

More accurate and realistic; reduces risk of low-valuation surprises.

5. Property Demand Cycle

Strong demand continues to support mortgage lending volumes.

9. Should You Buy in 2026 or Wait?

The answer depends on your financial goals:

You should buy in 2026 if:

- You want predictable mortgage payments

- You prefer stable EIBOR trends

- You need improved refinance options

- You aim to enter before price appreciation in 2026–2027

You may wait if:

- Your financial stability will significantly improve in 2027

- You expect better banking offers suited to your profile

However, most buyers benefit from entering the market during years of rate stability, not years of rate decline or rate spikes.

10. How Ricadi Mortgages Helps You Win in 2026

Ricadi Mortgages remains one of Dubai’s most trusted mortgage advisory firms because:

- We monitor EIBOR movements daily

- We negotiate bank margins aggressively

- We evaluate lender risk appetite based on internal criteria

- We guide buyers based on long-term economic cycles, not short-term speculation

- We specialise in expatriate, investor, and self-employed profiles

- We assist with refinancing, buyouts, valuations, and bank comparison

Through expert guidance, 2026 can be the year buyers lock one of the most efficient mortgage deals of the decade.

Conclusion: 2026 Is the Year of Strategic Mortgage Planning

EIBOR stability makes 2026 a rare opportunity for UAE homebuyers. With clearer rate expectations, softer fluctuations, and more competitive bank margins, the year ahead favours buyers who take informed decisions early — particularly in Q1 and Q2.

Whether you are buying your first home, refinancing, or investing, understanding EIBOR trends is not optional in 2026. It is the key financial lever shaping mortgage costs, long-term affordability, and wealth growth through UAE real estate.

With expert guidance from Ricadi Mortgages, your 2026 mortgage journey becomes data-driven, strategic, and optimized for long-term gain.