Buying a home in the UAE is not just a property transaction—it is a regulated financial journey involving banks, developers, valuation authorities, and government entities. In 2026, as lending criteria evolve and buyer awareness matures, understanding the entire mortgage process has become essential for avoiding delays, rejections, and costly mistakes.

In the UAE, mortgage regulations are underpinned local property authorities like ADREC (Abu Dhabi Real Estate Centre) and the DARI real estate registration platform. These entities govern mortgage eligibility, valuation approvals, and title deed registration across Abu Dhabi, giving local homebuyers and investors clarity on compliance expectations.

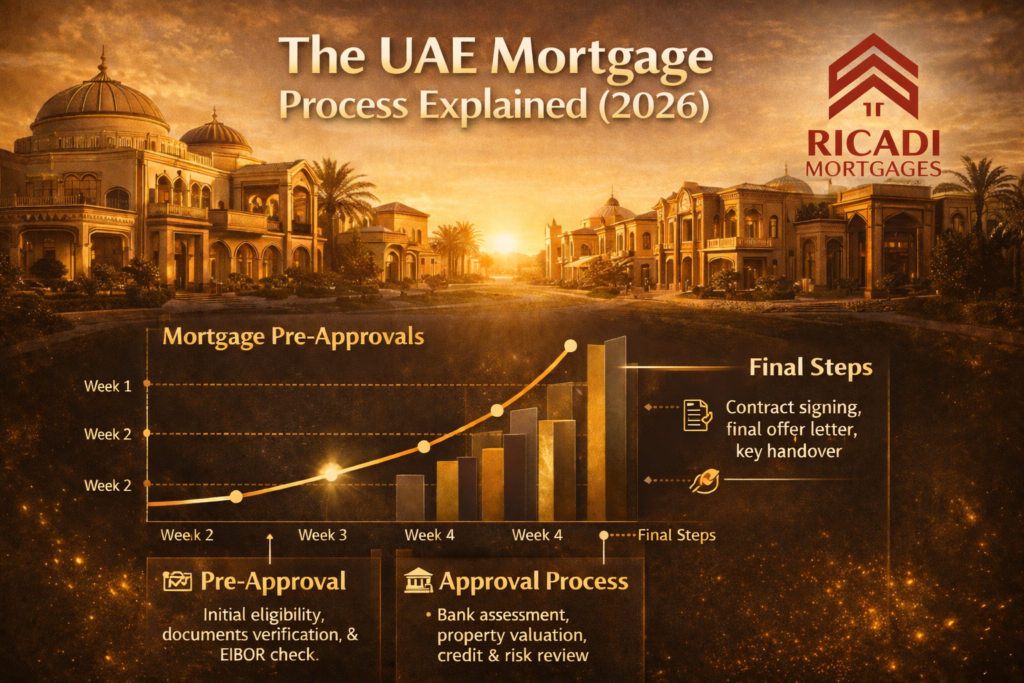

Mortgage Pre-approval to Key Handover – This guide is written to serve as a process authority pillar Ricadi Mortgages—clearly explaining how a UAE home loan works, while helping homebuyers move forward with confidence, clarity, and strategic foresight.

How the UAE Mortgage Process Really Works

A UAE mortgage follows a structured sequence. While the steps appear linear on paper, outcomes depend heavily on borrower profiling, documentation quality, bank appetite, and correct sequencing.

The most important insight for homebuyers is this:

A mortgage approval is not a single decision—it is a series of validations.

Understanding each stage helps buyers prepare proactively rather than reactively.

Mortgage Pre-Approval: The Foundation of Every Successful Purchase

What is mortgage pre-approval in the UAE?

Mortgage pre-approval in the UAE is a bank’s initial confirmation of how much you are eligible to borrow based on your income, liabilities, credit profile, and employment stability. It helps homebuyers understand their true purchasing power before committing to a property and reduces the risk of rejection later in the process.

Mortgage pre-approval is the stage where banks assess whether you are eligible to borrow and how much they are willing to lend.

This step happens before you commit to a property and determines your real purchasing power.

Banks evaluate:

- Income stability and source

- Existing liabilities and credit commitments

- Credit history and bureau score

- Employer profile and industry risk

- Nationality and residency status

A strong pre-approval gives buyers negotiating power, credibility with sellers, and protection from choosing properties outside their affordability range.

Learn more: mortgage pre-approval in the UAE

“Many buyers ask: ‘How long does pre-approval take in Abu Dhabi?’ — typically 3–7 working days with complete documentation.”

Mortgage Pre-Approval Quick Facts:

• Confirms how much a bank is willing to lend

• Provides negotiation leverage with sellers

• Typically valid 60–90 days in the UAE

Choosing the Right Mortgage Structure Before Application

Should you choose a fixed or variable mortgage rate before applying?

Choosing between a fixed or variable mortgage rate should happen before submitting a full application, as the structure affects monthly affordability, refinancing flexibility, and long-term financial exposure. The right choice depends on income stability, risk tolerance, and future plans rather than headline interest rates alone.

Before submitting a full application, borrowers must decide on their mortgage structure—fixed rate, variable rate, or a hybrid approach.

This decision affects:

- Monthly repayment comfort

- Exposure to interest rate movements

- Refinancing flexibility

- Long-term affordability

Homebuyers often make this choice too late or based solely on headline rates.

Learn more: fixed vs variable mortgage rates in the UAE

Property Identification and Sale Agreement

Once pre-approved, buyers proceed to identify a suitable property and sign a Memorandum of Understanding (MOU) or Sale and Purchase Agreement.

At this stage, banks require:

- Confirmed property details

- Agreed purchase price

- Initial deposit confirmation

A common mistake is signing agreements with unrealistic timelines or penalty clauses that do not align with mortgage approval cycles.

Bank Submission and Underwriting Assessment

After documentation is submitted, the application enters underwriting.

This is where banks perform deep risk assessment, reviewing:

- Salary consistency

- Variable income patterns

- Employer sustainability

- Financial behavior trends

Underwriting outcomes may include:

- Approval as submitted

- Conditional approval

- Reduced loan amount

- Rejection

This is often where independent mortgage advisors add the most value aligning borrower profiles with the right bank, not just any bank.

“What do banks look at during underwriting?” — banks assess salary consistency, employer profile, liabilities, and nationality in Abu Dhabi and Dubai.”

Property Valuation and Market Assessment

Once the borrower is approved, banks appoint an independent valuer to assess the property.

Valuation outcomes determine:

- Final loan-to-value (LTV)

- Whether the agreed price is supported

- Additional cash requirements, if any

If valuation falls short, buyers must bridge the gap—something many do not plan for in advance.

Professional advisory at this stage prevents contractual pressure later.

Local Cost Insight (Abu Dhabi): Buyers should plan for mortgage registration fees (approximately 0.1% of loan value) when registering with DARI. Other costs like bank processing and valuation fees also vary lender and property type.

Final Offer Letter and Legal Formalities

After valuation clearance, banks issue the final offer letter outlining:

- Interest rate structure

- Loan tenure

- Repayment schedule

- Fees and charges

Buyers must review this carefully, as this document defines long-term obligations.

This stage also includes coordination with:

- Developers

- Trustees

- Land departments

- Registration authorities

Accuracy and timing are critical here.

Registration, Disbursement, and Key Handover

The final phase involves:

- Mortgage registration

- Title deed issuance

- Fund disbursement to seller or developer

- Property handover

At this point, ownership is transferred, and mortgage repayments officially begin.

A well-managed process ensures seamless closure without last-minute delays.

Why UAE Mortgages Get Delayed or Rejected

Why do mortgage applications get rejected in the UAE?

Mortgage applications in the UAE are commonly rejected due to incomplete documentation, high existing liabilities, unstable income patterns, employer risk profiling, or applying to banks whose lending appetite does not match the borrower’s profile. Early advisory support significantly reduces rejection risk.

Despite eligibility, many mortgages face delays due to:

- Incomplete documentation

- Misaligned bank selection

- Overstated income assumptions

- Employer risk profiling

- Late-stage structural changes

Understanding these risk points early dramatically improves approval success.

Bank-Only Approach vs Independent Mortgage Advisory

Banks operate within product silos. Their role is to approve loans—not to assess suitability across the market.

Independent mortgage advisors like Ricadi Mortgages:

- Compare multiple banks simultaneously

- Match borrower profiles with lending appetite

- Structure loans based on life stage and future plans

- Anticipate underwriting challenges early

This advisory layer reduces friction and increases approval certainty.

How This Mortgage Process Fits Into Your Larger Financial Strategy

A mortgage should never exist in isolation.

It must align with:

- Long-term income trajectory

- Family planning

- Investment goals

- Refinancing opportunities

Frequently Asked Questions About the UAE Mortgage Process

1. How long does mortgage approval take in Dubai and Abu Dhabi?

Mortgage approval in Dubai and Abu Dhabi typically takes between 3-7 days, depending on documentation readiness, bank processing speed, property valuation timelines, and underwriting complexity.

2. Is mortgage pre-approval mandatory in the UAE?

Mortgage pre-approval is not legally mandatory in the UAE, but it is strongly recommended as it confirms eligibility early and prevents buyers from committing to properties beyond their approved budget.

3. Can I change my mortgage structure after pre-approval?

Yes, borrowers can usually change their mortgage structure after pre-approval, subject to bank policies and revised assessments, though doing so late may cause delays.

4. Do all banks follow the same mortgage process in the UAE?

While the overall mortgage framework is similar across UAE banks, timelines, documentation requirements, and risk appetite vary significantly between lenders.

5. How long does the entire mortgage process take in Abu Dhabi?

In Abu Dhabi and Dubai, the full mortgage cycle — from application to registration and handover — generally ranges from 3–6 weeks, influenced documentation readiness, bank underwriting timelines, and property valuation scheduling.

6. What are the typical fees involved in registering a mortgage in the UAE?

Government fees:

- 4% Dld of the property value

- 2% real estate of the property value

- 0.25% mortgage registration of the loan amount

- Title deed fee – 580+290 knowledge fee

- Trustee fee – 4200

Bank Fees:

Life insurance – 0.0112% per month of the loan amount

Valuation fee – 3150

Processing fee – Zero

Property Insurance – 0.525% per annum of the property value

7. Does the mortgage process differ for non-residents in the UAE?

Yes. Non-residents face additional documentation requirements and may have lower loan-to-value limits, but they can secure mortgages with proper income proof, passport/visa documentation, and bank underwriting alignment.

Final Perspective: Clarity Is the Greatest Advantage

In 2026, successful UAE homebuyers are not those who rush approvals—but those who understand the process deeply.

When the mortgage journey is structured correctly, buying a home becomes a confident progression rather than a stressful uncertainty.

Ricadi Mortgages exists to guide buyers through this journey with clarity, precision, and long-term thinking.

Thinking of buying a home in Dubai or Abu Dhabi?

Understanding the mortgage process is your strongest negotiating tool. Speak to Ricadi Mortgages for structured, independent mortgage guidance tailored to your financial future.

A strong pre-approval gives buyers negotiating power, credibility with sellers, and protection from choosing properties outside their affordability range.

This guide’s steps reflect typical Abu Dhabi and Dubai real estate financing practices in 2026, including mortgage registration, property valuation authority (ADREC / DARI), and bank underwriting requirements under UAE Central Bank oversight.

A) “What is pre-approval?”

Mortgage Pre-Approval (Answer): It is a bank’s written indication of borrowing capacity — usually issued in 3–7 working days — and strengthens your offer when negotiating property purchase price.

B) “What happens after property valuation?”

Final Offer Letter (Answer): After valuation confirms the property value aligns with the bank’s criteria, the lender issues a final offer letter with terms, rate structure, and repayment schedule.

C) “How long is the full process?”

Full UAE Mortgage Timeline (Answer): From application to key handover, most mortgage journeys in the UAE complete between 4–8 weeks under normal documentation and valuation conditions.