The UAE mortgage market in 2025 is more dynamic and competitive than ever, especially for first-time homebuyers, seasoned investors, and expats alike. One of the most pivotal decisions you will make when financing a property is choosing between a fixed or variable mortgage rate.

With global interest rates fluctuating, UAE Central Bank policies evolving, and lenders offering flexible packages, understanding this difference isn’t just financial literacy—it’s strategic decision-making.

In this definitive guide about mortgage, we’ll break down everything you need to know about fixed vs. variable mortgage rates in the UAE, backed 2025’s latest market insights. Whether you’re searching for the most stable repayment option or looking to leverage changing interest trends for savings, this blog is your complete answer.

What Is a Fixed Mortgage Rate?

A fixed mortgage rate means the interest you pay remains the same throughout the fixed term (commonly 1–5 years). Whether the market goes up or down, your repayments stay unchanged.

Ideal For:

- Risk-averse buyers

- Long-term financial planners

- Budget-conscious homeowners

Benefits:

- Payment stability

- Easier financial planning

- No surprise rate hikes

Limitations:

- Might miss out on falling interest rates

- Higher initial rates than variable options

What Is a Variable Mortgage Rate?

A variable mortgage rate fluctuates depending on the UAE’s EIBOR (Emirates Interbank Offered Rate) and lender margin. When interest rates dip, your mortgage payments may decrease—and vice versa.

Ideal For:

- Expats staying short-term

- Investors anticipating rate cuts

- Buyers with high income flexibility

Benefits:

- Potential for lower overall interest

- Flexibility in repayments

Limitations:

- Unpredictable monthly payments

- Risk of rate hikes impacting EMIs

Real-Time 2025 Bank Rate Snapshot

(Rates are indicative. Please verify with the respective bank for real-time updates.)

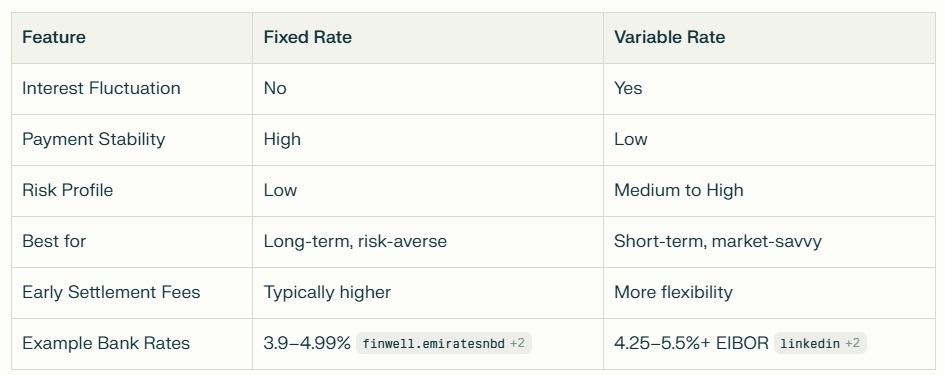

Fixed vs. Variable:

A Comparative Overview

Key Decision Factors –

Fixed vs Variable

1. Duration of Stay

If you’re an expat expecting to stay only 3–5 years, a variable rate might save you money. For long-term residents or families, fixed rates offer comfort.

2. Market Forecast 2025–2026

Experts anticipate gradual hikes in interest rates due to inflation control. Locking a fixed rate now could be advantageous.

3. Risk Appetite

Variable rates come with both savings potential and uncertainty. Evaluate how comfortable you are with fluctuating EMIs.

4. Budget Planning

Families and first-time buyers may prioritize stable payments, while investors may prefer dynamic returns.

5. Early Repayment Goals

Planning to settle early? Choose lenders with minimal prepayment penalties, usually available in variable products.

2025 Mortgage Trends in the UAE

- Rise in Hybrid Mortgages: Banks now offer blended fixed-variable plans.

- FinTech Tools for Rate Monitoring: Apps notify users about favorable interest changes.

- Expats Driving Demand: Especially from Europe and South Asia.

- Dubai & Abu Dhabi in Focus: As central hubs with stable real estate appreciation.

UAE Mortgage Rate Forecast Graph (2022–2026)

Mortgage Rate Trends in the UAE (2022–2026)

Visualize how fixed and variable mortgage rates have evolved and are projected to change.

UAE mortgage rate forecast from 2022 to 2026 showing fixed vs variable rates

Fixed vs. Variable Rate Comparison Table

A simple, clear markdown table to compare the main features.

What is Recommended: Fixed or Variable?

Plan Your Mortgage Smartly

Use our UAE Mortgage Calculator to estimate your monthly payments under both fixed and variable scenarios.

Top FAQs

Q1: Is a fixed or variable mortgage better for expats in UAE?

A fixed rate offers stability and is ideal for long-term stay. Variables may benefit short-term expats seeking lower rates.

Q2: Can I switch from fixed to variable during the term?

Some lenders offer conversion options mid-term, but fees and conditions apply. Check with your mortgage provider.

Q3: What is the current EIBOR rate in UAE?

As of August 2025, EIBOR hovers around 3.65%. It varies, so consult your bank for up-to-date values.

Q4: Are hybrid mortgage options available in UAE?

Yes, some banks now provide hybrid plans combining fixed and variable benefits.

Q5: Which banks offer the lowest rates in UAE?

Mashreq Bank and FAB often lead with competitive rates, but promotions vary monthly.

Ready to Compare the Best Rates?

Our expert advisors can help you evaluate the best-fit mortgage tailored to your goals.

Contact Ricadi Mortgages Today for a personalized consultation.