Key Takeaways: Best Mortgage Rates in UAE (2026) In the United Arab Emirates, property ownership is more than a milestone — it is a strategic financial decision. Whether you are purchasing a waterfront apartment in Dubai Marina or a family villa in Abu Dhabi, securing the best mortgage rates in UAE can dramatically influence your long-term wealth. However, many buyers focus only on the advertised interest rate. In reality, mortgage pricing in Dubai and Abu Dhabi is shaped multiple moving parts. Therefore, understanding how banks calculate rates — and how to position yourself correctly — is essential. The best…

-

-

Dubai’s property market continues to attract expats, first-time buyers, and global investors. The most searched mortgage questions in Dubai today revolve around eligibility, loan amount, interest rates, expat approval rules, down payments, and whether now is the right time to buy. The answers depend on income structure, debt-to-income ratio, residency status, property type, and bank policy. As a top mortgage consultant in Dubai, Ricadi Mortgages structures applications to align with UAE Central Bank regulations and individual bank underwriting standards — improving approval success and lowering total borrowing cost. Why This Blog Matters in 2026 Mortgage-related searches in Dubai have surged…

-

Mortgage Consultant in Dubai – Ricadi Mortgages In 2025, the UAE mortgage market is experiencing one of its strongest growth cycles in over a decade. Residential mortgage volumes have increased double-digit percentages year-on-year, with Dubai alone recording thousands of new mortgage registrations every month, driven end-users, expats relocating for long-term residency, and investors capitalising on stable yields. As interest rates stabilise and buyer confidence rises, navigating the mortgage process has become both an opportunity and a challenge — one that increasingly requires expert guidance from a seasoned Mortgage Consultant in Dubai like Ricadi Mortgages. This shift reflects a…

-

Working with a Mortgage Broker – A smarter mortgage decision for Dubai and Abu Dhabi homebuyers Buying a home in the UAE is no longer just a property decision. It is a financial strategy decision. In 2026, mortgage rules are tighter, bank risk checks are deeper, and approval timelines are less forgiving. Yet many buyers — especially first‑time buyers and expats — still walk directly into a bank believing it is the safest route. In reality, the fastest approvals, better rates, and smoother experiences increasingly come from working with an independent mortgage broker who understands how UAE banks actually assess…

-

Buying a home in the UAE is not just a property transaction—it is a regulated financial journey involving banks, developers, valuation authorities, and government entities. In 2026, as lending criteria evolve and buyer awareness matures, understanding the entire mortgage process has become essential for avoiding delays, rejections, and costly mistakes. In the UAE, mortgage regulations are underpinned local property authorities like ADREC (Abu Dhabi Real Estate Centre) and the DARI real estate registration platform. These entities govern mortgage eligibility, valuation approvals, and title deed registration across Abu Dhabi, giving local homebuyers and investors clarity on compliance expectations. Mortgage Pre-approval…

-

Fixed vs Variable Mortgage Rates in the UAE: A 2026 Decision Framework for Homebuyers Key Takeaways: For UAE homebuyers in 2026, the choice between a fixed-rate and a variable-rate mortgage is no longer a simple comparison of interest rates. It is a strategic financial decision shaped income stability, risk tolerance, long-term life planning, and evolving market conditions in Dubai, Abu Dhabi, and across the UAE. In a mortgage market influenced global rate cycles and increasingly informed buyers, selecting the right mortgage structure determines not just affordability today, but financial comfort for years to come. This comprehensive guide …

-

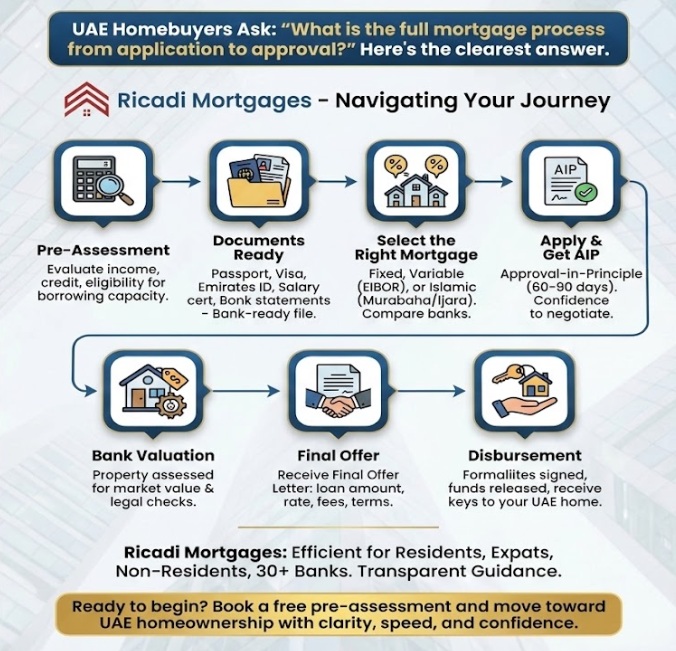

Full Mortgage Process From Application to Approval What Is the UAE Mortgage Process? The UAE mortgage process involves pre-assessment, document verification, approval-in-principle (AIP), property valuation, final bank approval, mortgage registration, and fund disbursement—typically completed within 3 to 6 weeks depending on the buyer profile and property readiness. Buying a home in the UAE—whether in Dubai, Abu Dhabi, or across the Emirates—is a major financial milestone. Yet for most first‑time and upcoming homebuyers, the mortgage approval journey feels complex, layered, and uncertain. Questions around eligibility, timelines, documents, interest rates, valuations, and bank approvals often delay confident decision‑making. In the UAE, mortgage…

-

Buying a Home in Abu Dhabi in 2026? How Ricadi Mortgages Helps You Choose the Right Bank If you’re thinking of buying a home in Abu Dhabi in 2026, your mortgage success depends less on finding the lowest advertised interest rate and more on choosing the right bank for your income profile, residency status, property type, and long-term financial goals. Working with an expert mortgage advisor like Ricadi Mortgages ensures faster approvals, stronger negotiation power, and a smoother home-buying experience from start to finish. Thinking of Buying a Home in Abu Dhabi in 2026? Here’s What Has Changed What makes…

-

The Smartest Way to Buy a Home in Dubai or Abu Dhabi in 2026 The most strategic way to buy a home in Dubai or Abu Dhabi in 2026 is to begin with a bank-approved mortgage plan that protects you from rate fluctuations, reduces upfront expenses, and aligns with lender eligibility criteria. Homebuyers who secure early guidance consistently achieve better rates, faster approvals, and smoother transfers. What Is the Best Mortgage Option in the UAE in 2026? There is no universal “best” mortgage.The smartest 2026 homebuyer strategy is a personalized mortgage structure—a tailored mix of stability (fixed) and flexibility (variable/switching)…

-

Facing a mortgage decision in 2025–26? This definitive, data-driven guide explains fixed vs variable mortgages in the UAE, how EIBOR and CBUAE policy moves affect your payments, timing for remortgaging, a worked calculator example, and a step--step decision framework so you can confidently fix, remortgage or switch lenders. Executive summary If your mortgage deal is ending or you’re buying now, decide combining three lenses: market signals (EIBOR & CBUAE), personal cashflow tolerance, and total cost (rates + fees + exit charges). Recent central-bank easing and active lender competition make preparation and comparison more valuable than ever. centralbank.ae+1 Why this…