Buying a property in the UAE is more than a financial investment — it’s a gateway to security, residency benefits, and long-term wealth. Yet, many aspiring homeowners and investors feel overwhelmed when it comes to understanding the mortgage process in UAE. With multiple banks, different mortgage types, varying requirements for residents and non-residents, and evolving Central Bank regulations, the process can feel daunting. But here’s the good news: with the right guidance, the UAE mortgage process is structured, predictable, and navigable. At Ricadi Mortgages, we simplify the journey — from your very first question about eligibility to the joyful moment…

-

-

Understanding mortgage eligibility in the UAE is the first step for anyone planning to buy property in Dubai, Abu Dhabi, or other emirates. Whether you are a resident, a salaried professional, a self-employed entrepreneur, or a non-resident investor, mortgage approval depends on specific rules, financial criteria, and documentation. In this comprehensive guide, we’ll break down eligibility requirements, the process, documents needed, costs involved, and even solutions for complicated or special cases. Why Mortgage Eligibility Matters in the UAE * Determines how much financing you can secure. * Impacts interest rates and repayment terms. * Helps you prepare financially before approaching…

-

Buying a home is one of the biggest financial decisions you’ll ever make — especially in a dynamic real estate market like the UAE. Whether you’re a first-time buyer, expat, investor, or want to release equity in your current property, getting the right mortgage is essential. But the difference between a good mortgage and the best mortgage can mean tens or hundreds of thousands of AED over the life of the loan. In this comprehensive guide, you’ll discover: If you are genuinely ready to buy, finance, or optimize an existing mortgage — read on. This is for you. Table of…

-

How to get Mortgage Pre-Approval in UAE Introduction: The Unsung First Step to Homeownership Buying a home in the UAE—whether in the glittering towers of Dubai Marina or the serene villas of Abu Dhabi—is more than a financial transaction; it is a life milestone. Yet, many eager buyers leap straight into browsing property listings without realizing that their first decisive move should be obtaining a mortgage pre-approval in UAE. Mortgage pre-approval is not just a banking formality; it is your financial compass. It tells you exactly how much you can borrow, the terms you qualify for, and the budget you…

-

Best Mortgage Options in Dubai vs. Abu Dhabi The UAE has long been a dream destination for property buyers. From Dubai’s glittering skyline to Abu Dhabi’s serene waterfronts, each city offers unique opportunities. But when it comes to mortgages, the differences between Dubai and Abu Dhabi can influence your decision significantly. In this blog, we’ll break down the rules, rates, fees, and buyer profiles in each city. By the end, you’ll know exactly which mortgage option aligns with your financial goals — whether you’re an investor chasing returns or a family seeking stability. Quick Snapshot: Dubai vs. Abu Dhabi Mortgages…

-

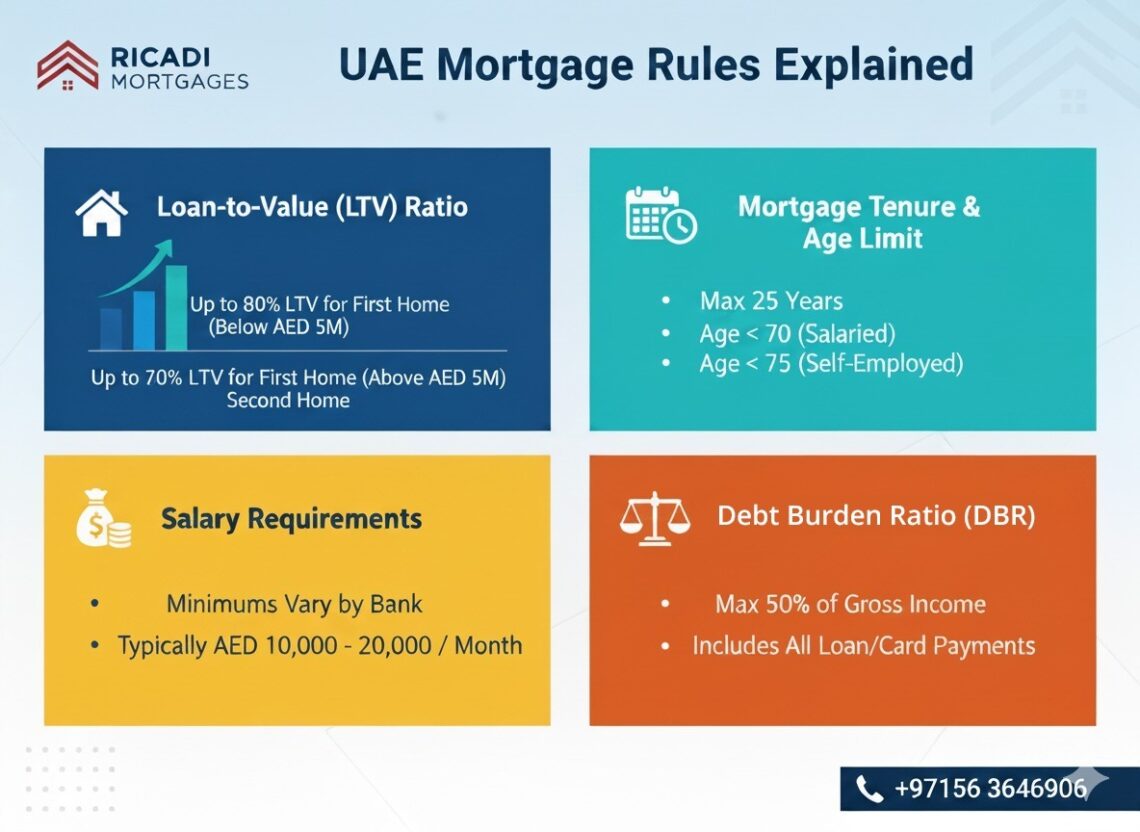

Buying a home in the UAE is an exciting milestone, especially for expats. But before you step into the property market, you must understand the mortgage rules set the UAE Central Bank. These rules determine how much you can borrow, for how long, and under what conditions. This blog breaks down the most important mortgage regulations — Loan-to-Value (LTV) ratios, mortgage tenure, salary requirements, and the Debt Burden Ratio (DBR) — in a clear, step--step way. Quick Snapshot: UAE Mortgage Rules Here’s a quick overview for expats and first-time buyers: 1. Loan-to-Value (LTV) Ratio Definition: LTV is the percentage…

-

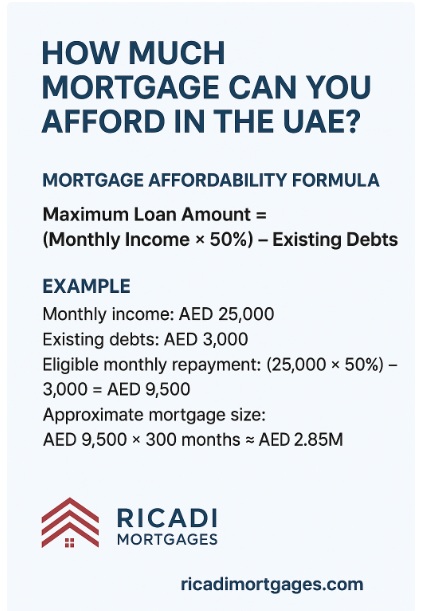

How Much Mortgage Can You Afford in the UAE? Try This Formula Buying a home in the UAE is one of the most exhilarating milestones for expats and residents alike. The glittering skyline of Dubai, the serene communities of Abu Dhabi, or the upcoming hotspots in Sharjah all invite you to invest, not just financially, but emotionally. Yet, the golden question remains: how much mortgage can you actually afford in the UAE?Unlike casual property browsing, mortgage affordability is bound strict regulations, formulas, and financial prudence. Get it right, and you unlock your dream villa or apartment. Get it wrong,…

-

Mortgage in UAE for Expats Buying your first home in the UAE is both exciting and daunting—especially if you’re an expat navigating a new system. From eligibility rules to bank approvals, the process can feel larinthine. This guide breaks it down into clear, actionable steps so you can move from aspiration to ownership with confidence. Step 1: Understand Who Can Apply for a Mortgage in the UAE “To qualify for a mortgage in the UAE as an expat, you need a valid residency visa, meet income criteria (AED 10K+), and fall within the age eligibility range set banks.” Step…

-

Refinancing a Mortgage in UAE – Let us Understand! Introduction: The Financial Crossroads of Homeownership in the UAE Owning a home in the UAE is not just a milestone—it’s an investment in one of the world’s most vibrant real estate markets. But as global interest rates fluctuate and personal financial goals evolve, many homeowners find themselves asking: Should I refinance my mortgage? Mortgage refinancing in the UAE has become increasingly popular among savvy homeowners who want to reduce their monthly payments, access equity, or secure more favorable terms. Yet, refinancing is not always the golden ticket; it requires careful analysis…

-

First-time homebuyer checklist iBuying your first home in the UAE is both thrilling and daunting. Between navigating mortgage pre-approval requirements, understanding property purchase laws, and aligning with Dubai Land Department processes, there’s a maze to cross before you hold the keys. This step--step UAE homebuyer guide is designed for first-time buyers in Dubai, Abu Dhabi, Sharjah, and beyond — covering mortgage rules, fees, documents, and expert tips so you can move from pre-approval to possession without costly mistakes. Quick Answer: First-Time Homebuyer Checklist in the UAE (Snippet-Ready) Step 1: Get a mortgage pre-approval from a UAE bank or broker.Step 2:…