Buying a home in the UAE is not just a property transaction—it is a regulated financial journey involving banks, developers, valuation authorities, and government entities. In 2026, as lending criteria evolve and buyer awareness matures, understanding the entire mortgage process has become essential for avoiding delays, rejections, and costly mistakes. In the UAE, mortgage regulations are underpinned local property authorities like ADREC (Abu Dhabi Real Estate Centre) and the DARI real estate registration platform. These entities govern mortgage eligibility, valuation approvals, and title deed registration across Abu Dhabi, giving local homebuyers and investors clarity on compliance expectations. Mortgage Pre-approval…

-

-

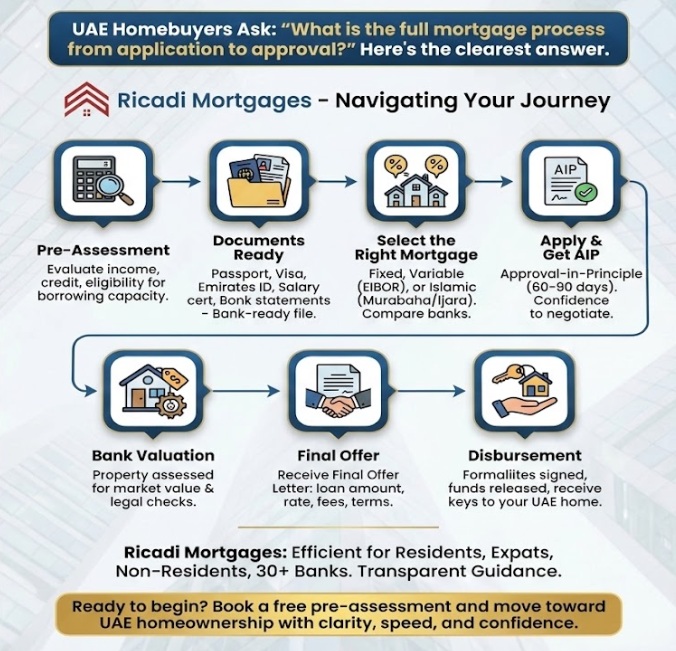

Full Mortgage Process From Application to Approval What Is the UAE Mortgage Process? The UAE mortgage process involves pre-assessment, document verification, approval-in-principle (AIP), property valuation, final bank approval, mortgage registration, and fund disbursement—typically completed within 3 to 6 weeks depending on the buyer profile and property readiness. Buying a home in the UAE—whether in Dubai, Abu Dhabi, or across the Emirates—is a major financial milestone. Yet for most first‑time and upcoming homebuyers, the mortgage approval journey feels complex, layered, and uncertain. Questions around eligibility, timelines, documents, interest rates, valuations, and bank approvals often delay confident decision‑making. In the UAE, mortgage…

-

The Smartest Way to Buy a Home in Dubai or Abu Dhabi in 2026 The most strategic way to buy a home in Dubai or Abu Dhabi in 2026 is to begin with a bank-approved mortgage plan that protects you from rate fluctuations, reduces upfront expenses, and aligns with lender eligibility criteria. Homebuyers who secure early guidance consistently achieve better rates, faster approvals, and smoother transfers. What Is the Best Mortgage Option in the UAE in 2026? There is no universal “best” mortgage.The smartest 2026 homebuyer strategy is a personalized mortgage structure—a tailored mix of stability (fixed) and flexibility (variable/switching)…

-

Facing a mortgage decision in 2025–26? This definitive, data-driven guide explains fixed vs variable mortgages in the UAE, how EIBOR and CBUAE policy moves affect your payments, timing for remortgaging, a worked calculator example, and a step--step decision framework so you can confidently fix, remortgage or switch lenders. Executive summary If your mortgage deal is ending or you’re buying now, decide combining three lenses: market signals (EIBOR & CBUAE), personal cashflow tolerance, and total cost (rates + fees + exit charges). Recent central-bank easing and active lender competition make preparation and comparison more valuable than ever. centralbank.ae+1 Why this…

-

UAE Mortgage Rates in 2026 Introduction: 2026 Marks a New Phase for UAE Home Financing As the UAE property market enters 2026, buyers face a vastly different lending landscape than the one shaped the intense rate hikes of 2022–2023 or the normalization cycles of 2024–2025. Today, EIBOR movements are more stable, global inflation is cooling, banks are recalibrating lending appetites, and homeowners are evaluating whether 2026 will be the golden window to lock in better mortgage terms. For first-time buyers and investors alike, 2026 is not simply about buying property — it is about understanding how EIBOR will behave,…

-

A Ricadi Mortgages Exclusive Advisory Introduction: The Golden Visa Era Has Reshaped Property Financing in the UAE The UAE’s Golden Visa has not only transformed residency—but also fundamentally changed the mortgage landscape for investors, residents, and global buyers.Today, a 10-year residency status is more than a visa category; it is a financial credibility badge, a risk-reduction indicator for banks, and a gateway to better mortgage privileges. Whether you are planning to buy your first home, invest in Dubai’s booming real estate, expand your property portfolio, or refinance an existing loan, the Golden Visa significantly shifts what banks can offer you.…

-

How to Switch Banks & Buy Out Your Mortgage Introduction: Why 2025 is the Year of Smarter Mortgage Moves The UAE mortgage market in 2025 is seeing a wave of homeowners taking control of their finances. With the U.S. Federal Reserve signaling another rate cut and local banks adjusting their EIBOR-linked home loans, mortgage rates in the UAE are at some of the lowest levels in years. As of October 2025, fixed mortgage rates are hovering between 3.75% and 4.50%, depending on tenure and profile. That’s a major drop from the 6–7% levels many borrowers were paying in 2022–23. Naturally,…

-

Best Mortgage Options in Dubai vs. Abu Dhabi The UAE has long been a dream destination for property buyers. From Dubai’s glittering skyline to Abu Dhabi’s serene waterfronts, each city offers unique opportunities. But when it comes to mortgages, the differences between Dubai and Abu Dhabi can influence your decision significantly. In this blog, we’ll break down the rules, rates, fees, and buyer profiles in each city. By the end, you’ll know exactly which mortgage option aligns with your financial goals — whether you’re an investor chasing returns or a family seeking stability. Quick Snapshot: Dubai vs. Abu Dhabi Mortgages…