Complicated Mortgage Cases in UAE When “No” from the Bank Isn’t the Final Answer In the refined financial corridors of Dubai and Abu Dhabi, every property story begins with ambition — a luxury villa on the Palm, an investment apartment in Downtown, or a second home in the heart of Marina. But for many discerning buyers, the road to mortgage approval is anything but straightforward. Complex income structures, international earnings, fluctuating currencies, visa transitions, offshore assets, or non-standard documentation — these aren’t rare anomalies; they are realities of the modern global investor. This is where Ricadi Mortgages distinguishes itself —…

-

-

(A definitive guide for residents, non-residents, and investors in Dubai, Abu Dhabi, and across the Emirates) Introduction: Turning Paperwork into Property Power When buying your dream home or investment property in the UAE, the mortgage process often feels like a larinth of forms and requirements. Yet, every signature and every document plays a crucial role in securing the best financing terms. Whether you’re a first-time homebuyer in Dubai, a non-resident investor in Abu Dhabi, or looking to refinance your existing loan, knowing which mortgage documents are required can save you weeks of delay and endless back-and-forth with banks. This guide,…

-

Buying a property in the UAE is more than a financial investment — it’s a gateway to security, residency benefits, and long-term wealth. Yet, many aspiring homeowners and investors feel overwhelmed when it comes to understanding the mortgage process in UAE. With multiple banks, different mortgage types, varying requirements for residents and non-residents, and evolving Central Bank regulations, the process can feel daunting. But here’s the good news: with the right guidance, the UAE mortgage process is structured, predictable, and navigable. At Ricadi Mortgages, we simplify the journey — from your very first question about eligibility to the joyful moment…

-

Understanding mortgage eligibility in the UAE is the first step for anyone planning to buy property in Dubai, Abu Dhabi, or other emirates. Whether you are a resident, a salaried professional, a self-employed entrepreneur, or a non-resident investor, mortgage approval depends on specific rules, financial criteria, and documentation. In this comprehensive guide, we’ll break down eligibility requirements, the process, documents needed, costs involved, and even solutions for complicated or special cases. Why Mortgage Eligibility Matters in the UAE * Determines how much financing you can secure. * Impacts interest rates and repayment terms. * Helps you prepare financially before approaching…

-

How to get Mortgage Pre-Approval in UAE Introduction: The Unsung First Step to Homeownership Buying a home in the UAE—whether in the glittering towers of Dubai Marina or the serene villas of Abu Dhabi—is more than a financial transaction; it is a life milestone. Yet, many eager buyers leap straight into browsing property listings without realizing that their first decisive move should be obtaining a mortgage pre-approval in UAE. Mortgage pre-approval is not just a banking formality; it is your financial compass. It tells you exactly how much you can borrow, the terms you qualify for, and the budget you…

-

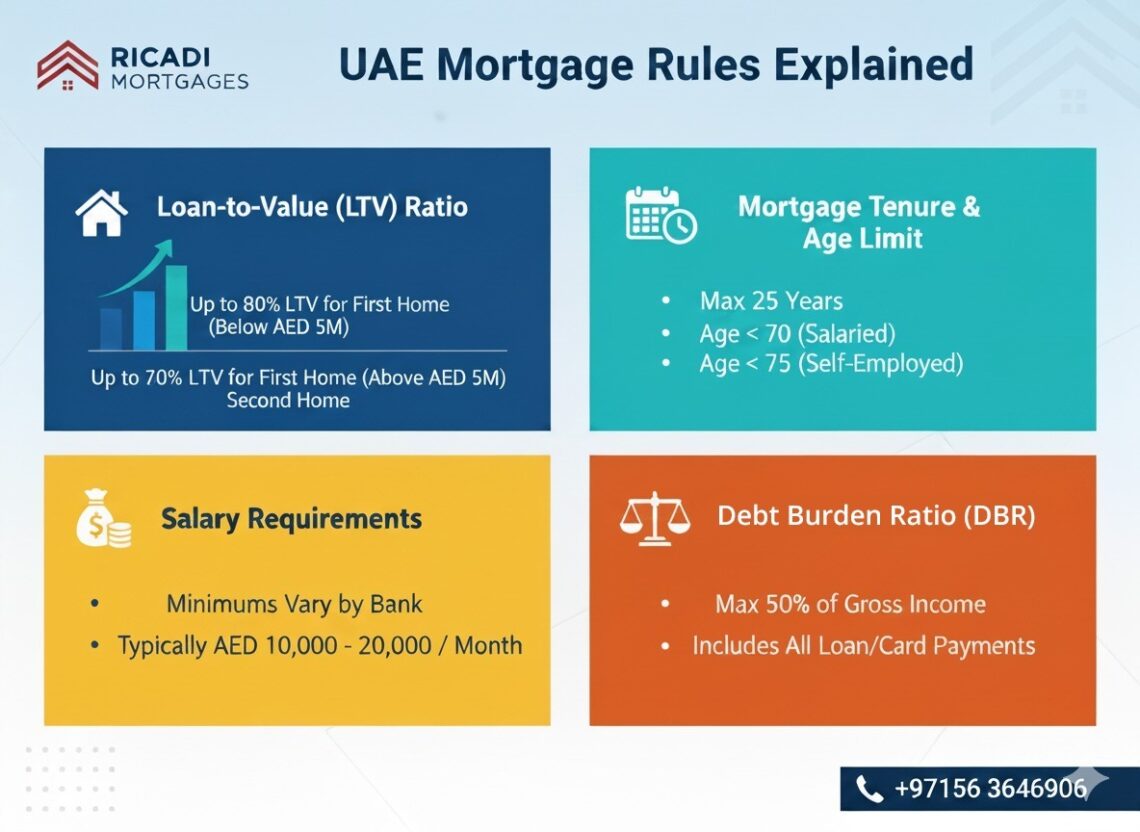

What Are UAE Mortgage Rules in 2026? UAE mortgage rules are regulated the UAE Central Bank and include LTV caps (75–80%), a maximum 50% debt burden ratio, minimum salary requirements, and tenure limits up to age 65–70. Buying a home in the UAE is an exciting milestone, especially for expats. However, before stepping into the property market, it is essential to understand the mortgage regulations set the Central Bank of the UAE. These rules determine how much you can borrow, for how long, and under what conditions. This guide explains the most important mortgage regulations — Loan-to-Value (LTV)…

-

First-time homebuyer checklist iBuying your first home in the UAE is both thrilling and daunting. Between navigating mortgage pre-approval requirements, understanding property purchase laws, and aligning with Dubai Land Department processes, there’s a maze to cross before you hold the keys. This step--step UAE homebuyer guide is designed for first-time buyers in Dubai, Abu Dhabi, Sharjah, and beyond — covering mortgage rules, fees, documents, and expert tips so you can move from pre-approval to possession without costly mistakes. Quick Answer: First-Time Homebuyer Checklist in the UAE (Snippet-Ready) Step 1: Get a mortgage pre-approval from a UAE bank or broker.Step 2:…