Buying a home in the UAE is not just a property transaction—it is a regulated financial journey involving banks, developers, valuation authorities, and government entities. In 2026, as lending criteria evolve and buyer awareness matures, understanding the entire mortgage process has become essential for avoiding delays, rejections, and costly mistakes. This guide is written to serve as a process authority pillar for Ricadi Mortgages—clearly explaining how a UAE home loan works, while helping homebuyers move forward with confidence, clarity, and strategic foresight. How the UAE Mortgage Process Really Works A UAE mortgage follows a structured sequence. While the steps appear…

-

-

Fixed vs Variable Mortgage Rates in the UAE: A 2026 Decision Framework for Homebuyers For UAE homebuyers in 2026, the choice between a fixed-rate and a variable-rate mortgage is no longer a simple comparison of interest rates. It is a strategic financial decision shaped income stability, risk tolerance, long-term life planning, and evolving market conditions in Dubai, Abu Dhabi, and across the UAE. In a mortgage market influenced global rate cycles and increasingly informed buyers, selecting the right mortgage structure determines not just affordability today, but financial comfort for years to come. This comprehensive guide Ricadi Mortgages…

-

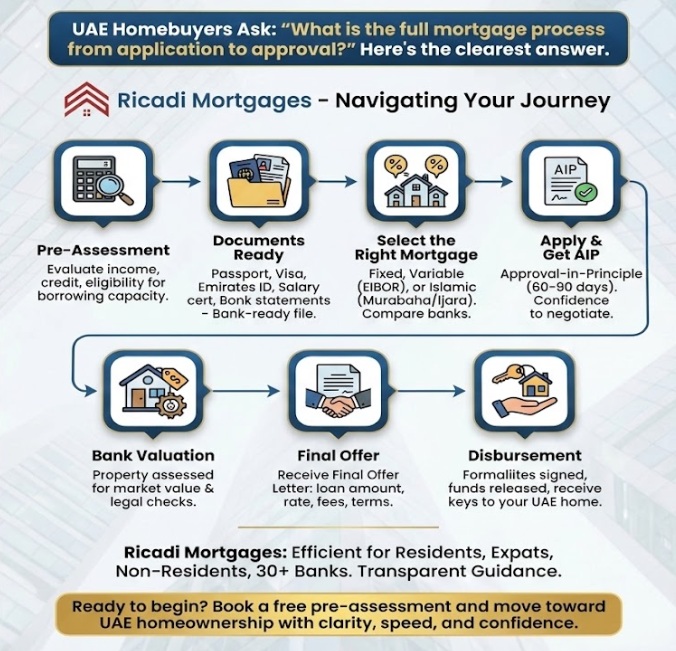

Full Mortgage Process From Application to Approval Buying a home in the UAE—whether in Dubai, Abu Dhabi, or across the Emirates—is a major financial milestone. Yet for most first‑time and upcoming homebuyers, the mortgage approval journey feels complex, layered, and uncertain. Questions around eligibility, timelines, documents, interest rates, valuations, and bank approvals often delay confident decision‑making. At Ricadi Mortgages, we work closely with UAE residents, expats, and non‑residents to simplify this journey—offering bank‑neutral advice, structured guidance, and end‑to‑end mortgage support from application to approval. This comprehensive guide explains every stage of the UAE mortgage process, aligned with the latest Central…

-

Buying a Home in Abu Dhabi in 2026? How Ricadi Mortgages Helps You Choose the Right Bank If you’re thinking of buying a home in Abu Dhabi in 2026, your mortgage success depends less on finding the lowest advertised interest rate and more on choosing the right bank for your income profile, residency status, property type, and long-term financial goals. Working with an expert mortgage advisor like Ricadi Mortgages ensures faster approvals, stronger negotiation power, and a smoother home-buying experience from start to finish. Thinking of Buying a Home in Abu Dhabi in 2026? Here’s What Has Changed Abu Dhabi’s…

-

Mortgage in UAE for Expats Buying your first home in the UAE is both exciting and daunting—especially if you’re an expat navigating a new system. From eligibility rules to bank approvals, the process can feel larinthine. This guide breaks it down into clear, actionable steps so you can move from aspiration to ownership with confidence. Step 1: Understand Who Can Apply for a Mortgage in the UAE “To qualify for a mortgage in the UAE as an expat, you need a valid residency visa, meet income criteria (AED 10K+), and fall within the age eligibility range set banks.” Step…

-

First-time homebuyer checklist iBuying your first home in the UAE is both thrilling and daunting. Between navigating mortgage pre-approval requirements, understanding property purchase laws, and aligning with Dubai Land Department processes, there’s a maze to cross before you hold the keys. This step--step UAE homebuyer guide is designed for first-time buyers in Dubai, Abu Dhabi, Sharjah, and beyond — covering mortgage rules, fees, documents, and expert tips so you can move from pre-approval to possession without costly mistakes. Quick Answer: First-Time Homebuyer Checklist in the UAE (Snippet-Ready) Step 1: Get a mortgage pre-approval from a UAE bank or broker.Step 2:…