Full Mortgage Process From Application to Approval

What Is the UAE Mortgage Process?

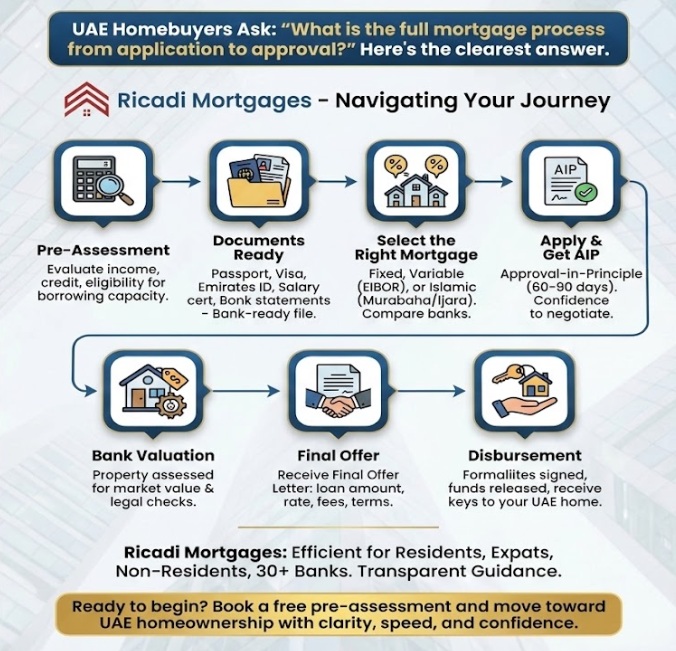

The UAE mortgage process involves pre-assessment, document verification, approval-in-principle (AIP), property valuation, final bank approval, mortgage registration, and fund disbursement—typically completed within 3 to 6 weeks depending on the buyer profile and property readiness.

Buying a home in the UAE—whether in Dubai, Abu Dhabi, or across the Emirates—is a major financial milestone. Yet for most first‑time and upcoming homebuyers, the mortgage approval journey feels complex, layered, and uncertain. Questions around eligibility, timelines, documents, interest rates, valuations, and bank approvals often delay confident decision‑making.

In the UAE, mortgage procedures can vary slightly between emirates. In Abu Dhabi and Dubai, regulatory bodies like ADREC (Abu Dhabi Real Estate Centre) and the DARI land registry play a key role in property valuation and mortgage registration. Including these local signals helps buyers understand precise compliance requirements in each emirate.

At Ricadi Mortgages, we work closely with UAE residents, expats, and non‑residents to simplify this journey—offering bank‑neutral advice, structured guidance, and end‑to‑end mortgage support from application to approval.

This comprehensive guide explains every stage of the UAE mortgage process, aligned with the latest Central Bank regulations, lender practices, and real‑world approval timelines.

Step 1: Mortgage Pre‑Assessment – Understanding Your Real Eligibility

The mortgage journey begins with a financial pre‑assessment, one of the most critical steps for UAE homebuyers.

Banks assess:

- Monthly income and employment stability

- Credit history via Al Etihad Credit Bureau (AECB)

- Existing liabilities (loans, credit cards, BNPL facilities)

- Debt Burden Ratio (DBR) – capped at 50% the UAE Central Bank

- Residency status (resident or non‑resident)

A professional pre‑assessment gives clarity on:

- Maximum loan eligibility

- Realistic property budget

- Expected EMI obligations

Typical timeline: 1–3 working days with complete information.

At Ricadi Mortgages, this step ensures buyers avoid over‑commitment and approach banks with confidence.

In the UAE, mortgage pre-assessment evaluates your eligibility under Central Bank regulations, including debt burden ratio (DBR), income stability, AECB credit score, residency status, and employer profile. This step determines realistic borrowing capacity before approaching banks.

Step 2: Document Preparation – Creating a Bank‑Ready File

UAE mortgage approvals are highly documentation‑driven. A clean and complete file significantly reduces delays.

Common documents include:

- Passport and valid visa

- Emirates ID (for residents)

- Salary certificate or trade license

- 3–6 months bank statements

- AECB credit report

- Proof of address

Self‑employed applicants may also need audited financials and company bank statements.

Expert tip: Incomplete or inconsistent documents are the most common reason for approval delays.

Banks in the UAE apply strict KYC and AML checks. Accurate documentation upfront reduces approval delays and minimizes valuation or compliance rejections later in the mortgage process.

Step 3: Choosing the Right Mortgage Product

UAE homebuyers can select from multiple mortgage options:

- Fixed‑rate mortgages – predictable EMIs for stability

- Variable‑rate mortgages – linked to EIBOR

- Islamic mortgages – Murabaha, Ijara, Musharakah structures

Each product impacts long‑term affordability, refinancing flexibility, and early settlement charges.

Ricadi Mortgages compares offers across 30+ UAE banks, focusing not just on rates—but also on approval strength and long‑term suitability.

Most UAE banks structure mortgages using fixed-rate introductory periods followed EIBOR-linked variable rates. Product suitability depends on risk tolerance, income predictability, and long-term ownership plans.

Step 4: Mortgage Application & Approval‑in‑Principle (AIP)

Once the application is submitted, banks issue an Approval‑in‑Principle (AIP)—a conditional confirmation of eligibility.

- Valid for 60–90 days

- Allows buyers to negotiate property prices

- Enables payment of booking deposits

Typical timeline: 3–7 working days (with complete documentation).

An AIP is not a final approval. UAE banks may revise loan terms after property valuation, employer verification, or updated liability checks before issuing a Final Offer Letter.

Step 5: Property Valuation & Legal Checks

After signing the Sale Agreement, the bank appoints an independent valuer to assess the property.

Key points:

- Loan amount is calculated on the lower of purchase price or valuation

- Title deed, developer approvals, and compliance are verified

Typical timeline: 5–7 working days.

This stage is crucial, as valuation outcomes directly impact the final loan amount.

Property valuation in Abu Dhabi follows DARI and ADREC-approved frameworks. Banks lend on the lower of the purchase price or valuation, ensuring compliance with local real estate regulations.

Step 6: Final Offer Letter & Down Payment

Following successful valuation, the bank issues a Final Offer Letter (FOL) outlining:

- Approved loan amount

- Interest or profit rate

- Loan tenure

- Processing fees

- Insurance requirements

- Early settlement terms

Down payment norms:

- UAE residents: Typically 20%

- Non‑residents: Typically 25% or more

Additional costs include transfer fees, registration charges, and trustee fees.

Down payments in the UAE are regulated loan-to-value (LTV) caps. Residents typically require 20% for properties under AED 5 million, while non-residents may require higher equity contributions.

Step 7: Mortgage Disbursement & Property Handover

Once agreements are signed and conditions met:

- The bank disburses funds directly to the seller or developer

- Ownership transfers at the land department

- Keys are handed over

Typical timeline: 2–5 working days post‑signing.

This completes the journey from application to approval—and into homeownership.

“When do I get the keys after mortgage approval in UAE?”

Once the mortgage is registered, banks release funds directly to the seller, and ownership transfer is completed at the relevant land department or trustee office—after which keys are handed over to the buyer.

Understanding Key Mortgage Terms (Quick Glossary)

- AIP: Approval‑in‑Principle

- DBR: Debt Burden Ratio (maximum 50%)

- LTV: Loan‑to‑Value ratio

- EIBOR: Emirates Interbank Offered Rate

Why UAE Homebuyers Choose Ricadi Mortgages

Ricadi Mortgages provides:

- Bank‑neutral advisory across leading UAE lenders

- Expertise for residents, expats, and non‑residents

- Faster approvals through structured documentation

- Transparent guidance with no hidden surprises

- End‑to‑end support from eligibility to disbursement

In Abu Dhabi, mortgage registrations are governed ADREC, with registration fees typically around 0.1% of the loan amount, excluding trustee and administrative charges. Growing population inflows, infrastructure investments, and sustained demand in prime residential zones continue to shape mortgage approval trends across the emirate.

Fixed vs Variable Mortgage Rates in UAE

Complete UAE Mortgage Process 2026

Buying a Home in Abu Dhabi in 2026

Frequently Asked Questions (FAQs)

How long does mortgage approval take in the UAE?

With complete documents, approvals typically take 2–4 weeks, depending on the bank and property.

Can non‑residents get a mortgage in the UAE?

Yes. Non‑residents can obtain mortgages with higher down payments and specific documentation requirements.

What credit score is required for UAE mortgages?

A clean AECB credit history with responsible repayment behavior significantly improves approval chances.

How long does mortgage approval take in the UAE?

Mortgage approvals typically take 3–6 weeks, depending on documentation readiness, property valuation, and bank processing timelines.

Can expats get a mortgage in the UAE?

Yes. UAE residents and non-residents can apply for mortgages, subject to income eligibility, credit profile, and LTV limits set banks.

Is pre-approval mandatory before buying property in the UAE?

While not legally mandatory, pre-approval is strongly recommended as it defines budget clarity and strengthens negotiation power.

Final Thoughts for UAE Homebuyers

The UAE mortgage process is structured—but only when navigated with clarity and expertise. Understanding each stage helps buyers avoid delays, manage expectations, and negotiate confidently.

If you are planning to buy a home in Dubai, Abu Dhabi, or anywhere in the UAE, Ricadi Mortgages helps you move from application to approval with clarity, speed, and confidence.