Buying a home in the UAE is an exciting milestone, especially for expats. But before you step into the property market, you must understand the mortgage rules set the UAE Central Bank. These rules determine how much you can borrow, for how long, and under what conditions.

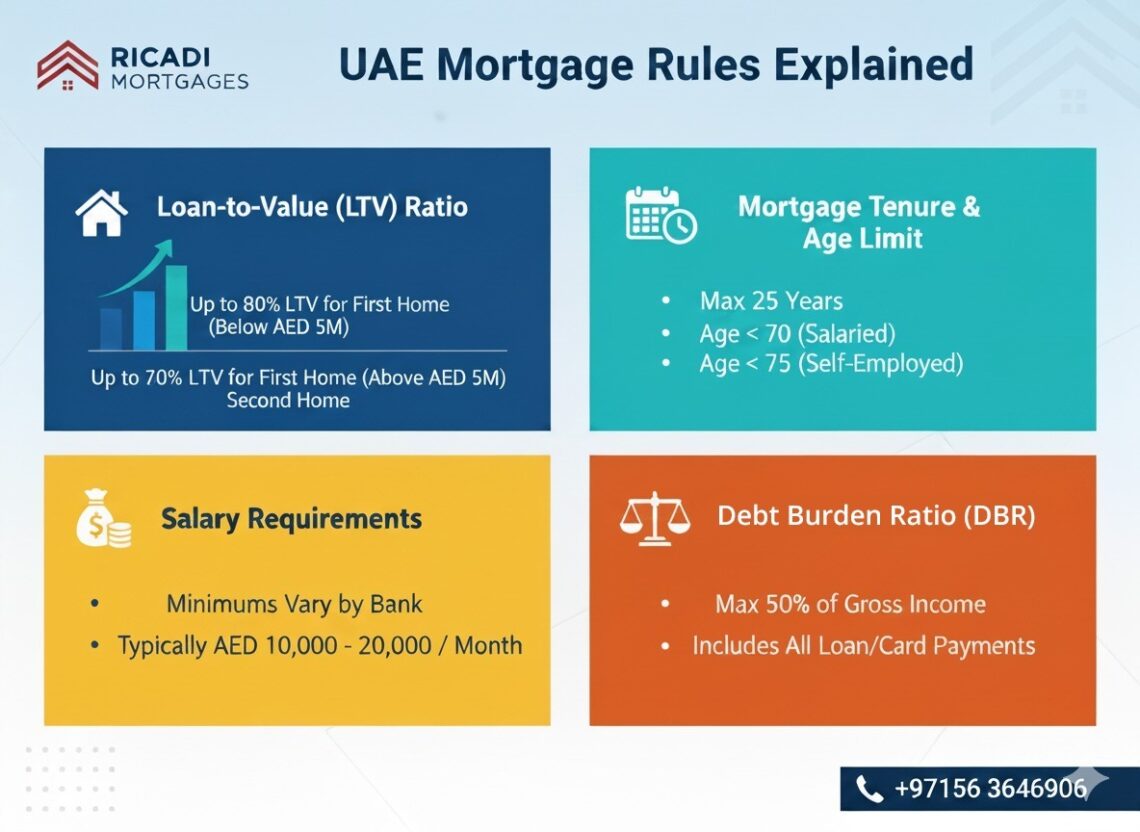

This blog breaks down the most important mortgage regulations — Loan-to-Value (LTV) ratios, mortgage tenure, salary requirements, and the Debt Burden Ratio (DBR) — in a clear, step--step way.

Quick Snapshot: UAE Mortgage Rules

Here’s a quick overview for expats and first-time buyers:

- Loan-to-Value (LTV): 80% max for first property (expats).

- Tenure: Max 25 years, up to borrower age 65 (salaried) or 70 (self-employed).

- Salary Requirement: AED 15,000–25,000 (typical minimum, varies bank).

- Debt Burden Ratio (DBR): Max 50% of net monthly income.

- Down Payment: 20%–25% minimum for expats (depending on property value).

1. Loan-to-Value (LTV) Ratio

Definition: LTV is the percentage of a property’s value that banks can finance.

- For expats buying their first property under AED 5M, the max LTV is 80%.

- If the property is above AED 5M, the LTV limit drops to 70%.

- For second properties, it reduces further to 60%–65%.

Example: If you buy a villa worth AED 2M, the maximum mortgage you can secure is AED 1.6M. The remaining AED 400K must be paid upfront as down payment.

2. Mortgage Tenure

Definition: The maximum number of years you can repay a home loan.

- UAE banks allow mortgage tenure up to 25 years.

- However, there’s an age limit:

- Salaried expats: repayments must end before age 65.

- Self-employed expats: repayments must end before age 70.

Example: If you are 45 years old, salaried, and applying for a loan, your maximum tenure is 20 years (until you reach 65).

3. Salary Requirements

Definition: The minimum monthly income required to qualify for a UAE mortgage.

- Banks generally expect AED 15,000–25,000 monthly income for expats.

- Requirements vary: some lenders may accept AED 12,000 for small properties, while premium banks require AED 25,000+.

- Stability matters: Length of employment, employer category, and credit score all affect eligibility.

Example: A salaried professional with AED 20,000 income and no debt commitments may qualify for an AED 1.5M–1.8M mortgage.

4. Debt Burden Ratio (DBR) Rule

Definition: DBR is the percentage of your net monthly income (NMI) that can go toward debt repayments.

- As per UAE Central Bank: max 50% of your NMI can be used for debts (including mortgages, car loans, credit cards).

- All existing obligations are included before calculating affordability.

Example:

- NMI = AED 25,000

- Existing debt = AED 3,000

- DBR limit = 50% × 25,000 = AED 12,500

- Available for mortgage = 12,500 – 3,000 = AED 9,500

Quick Reference Table: UAE Mortgage Rules

| Rule | Details (Expats) | Example |

|---|---|---|

| Loan-to-Value (LTV) | 80% up to AED 5M property; 70% above AED 5M | AED 2M villa → AED 1.6M mortgage |

| Tenure | Max 25 years; end age 65 (salaried), 70 (self-employed) | 45 y/o salaried → 20 years max |

| Salary Requirement | AED 15,000–25,000 (varies bank) | AED 20K income → AED 1.5M loan |

| Debt Burden Ratio (DBR) | Max 50% of NMI can be used for debt | NMI 25K, debt 3K → 9.5K for mortgage |

| Down Payment | 20%–25% minimum | AED 2M home → AED 400K upfront |

FAQs on UAE Mortgage Rules

1. Can expats get 100% mortgage in the UAE?

No. Expats must make a down payment of at least 20%–25%, depending on property value.

2. What is the maximum mortgage tenure in Dubai or Abu Dhabi?

25 years, subject to age limit (65 salaried / 70 self-employed).

3. Does credit score affect mortgage approval in the UAE?

Yes. While not a rule law, most banks check your AECB credit score before approving.

Why Work With Ricadi Mortgages?

UAE mortgage rules can be overwhelming, but with Ricadi Mortgages, you don’t have to navigate them alone.

- We specialize in expat mortgages across Dubai, Abu Dhabi, and beyond.

- Our experts simplify LTV, DBR, and bank policies to secure the best deal for you.

- From eligibility checks to bank negotiations, we manage the process end-to-end.

Call us today: +97156-364-6906

Visit: www.ricadimortgages.com